EVs in the air may seem like an obvious development, but the technology to power them presents a whole new set of challenges. Will eVTOL R&D diverge from, and even reshape, the EV battery industry as a whole?

Worldwide commercial deployment of electric vertical take-off and landing (eVTOL) aircraft is rapidly approaching, and these clean, quiet cloud-runners will perhaps soon be part of everyday life. Air-taxis and other flight-ready craft stand on the shoulders of the conventional EV industry, yet without recent leaps in cell energy density, would never have got off the ground. But despite a common destiny so, eVTOL and EV are vastly different.

The first major difference between these two airborne applications is in the power requirements.

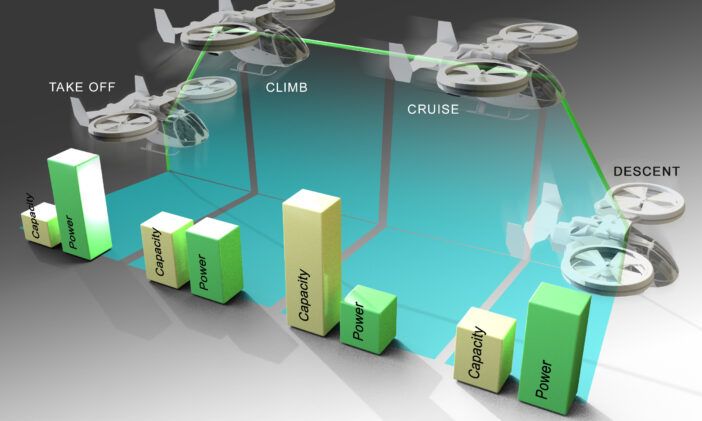

“They’re tremendous compared to an automobile EV, and over a very short time span,” says Dr. Ilias Belharouak, Head of the Electrification department at Oak Ridge National Laboratory (ORNL), the world’s largest energy lab. “Typically, 30 to 45 seconds of massive energy is needed to take [an eVTOL] to a certain altitude, and then cruising that platform for a certain number of miles, then descending.”

Battery power is expressed in C-rate, where 1C is a rate of discharge that would drain it in one hour. For descent and landing, an eVTOL must achieve a whopping 15C for short periods. Factor in margins of error, needing to make multiple landing attempts, for example, and you are looking at a whole lot of battery.

“We’re talking about 2-3 order of magnitude in power compared to EVs,” says Belharouak.

ORNL is dedicated to unravelling the secrets of high-power batteries, running experimental designs through a rigorous testing process that simulates the intense demands of take-off, cruise and landing.

“In our laboratory we’re trying to mimic the conditions under which the flying platform would operate,” says Belharouak. “So, it’s about mechanical stress, vibration and altitude and the low temperature that entails, conditions not seen for ground-EVs.”

Often, researchers are finding that it comes down to the specific composition of the electrolytes within the cell and are developing formulations that can stabilize the chemistry inside those cells under such conditions.

Certain battery and cell features are necessary for high-power output, and ORNL is investigating that too. “You have important design decisions,” says Belharouk, “Effective power output depends on the thickness of the electrodes, as well as the electrolytes used in the cell. In our R&D one of the key innovations is in the optimisation of the ionic conductivity and the transference number of the electrolytes.”

But what they’re finding is that there are trade-offs. Decisions need to be made on balancing the needs of eVTOL, while also considering range and safety.

“There’s definitely a compromise,” says Belharouk. “Automotive EV batteries are energy dense, and because of that we can run them for hundreds of miles. But those kinds of batteries are not designed to provide high power over a shorter period.”

Safety in the air

Safety in the air

The main attraction of eVTOLs is that they are runway independent, they can land and takeoff from a relatively small footprint. Once in the sky, many operate like a conventional aircraft, with aero foil wings and forward thrust propellors.

“For every kilogram of battery weight that we have to carry, that’s another 10 newtons of vertical thrust that we need to get the thing up into the air,” says Ian Thomas, founder of Novel Engineering, working directly on new approaches to eVTOL safety. “So, you don’t want to end up with diminishing returns. That battery needs to be able to pack the extra power.

“Traditional aviation uses jet fuel, because it’s got high specific energy. 12,000 wh/kg. So those are great numbers, whereas lithium-ion batteries are about 300 wh/kg. So, if you want to fly from London to Barcelona you’d need five tons of jet fuel, but [for an eVTOL] you’d need 200 tons of battery.”

These are ballpark figures, but the picture is clear: to one day supplant the Boeing 747, both energy density and specific energy will need to ramp up. But today, eVTOL’s and their batteries are limited to much shorter flights, and much lighter aircraft.

Anybody who has been watching the development of eVTOL will be aware that safety certification is a major hurdle, and one that has pushed back the commercialization process. “The aircraft need to be much more ruggedized and robust to the really high forces involved in a crash,” says Thomas.

For the best of reasons, FAA (USA) and EASA (EU) approval require stringent proof that an eVTOL is safe. Recently, this has involved Archer Aviation subjecting its five-seater eVTOL Midnight’s batteries to 50ft drop impacts. Because approval can be such an arduous and time-consuming process, Novel Engineering has developed an application they call Safe Cert AI, which helps expedite the data crunching involved. They say it can speed up the process by 80%.

“It was inspired by the safety cases we do for many of our clients,” says Thomas. “Could we do it faster? More efficiently? More cost effectively? Combining that with the latest developments in AI and LLMs, it’s an automated tool that can do a lot of the legwork in safety.”

And extra tools for safety are direly needed. Even momentary and partial failure in power supply can lead to catastrophe while airborne, and power demands create extra problems.

“When you draw high power to the batteries, the baseline electrolytes will heat tremendously,” says Belharouk, “Which can lead to some safety concerns.”

Those include thermal runaway, an oddly reassuring phrase that here describes an eVTOL turning into a blazing fireball and crashing to earth, which is a huge concern for both passengers and whoever might be walking about below.

Again, tweaking the electrolyte formulation is the approach ORNL has gone for. However, many eVTOL poised for production instead have dedicated liquid-cooling systems, notably the Lilium Jet and the Joby S4. This comes at a weight cost, up to 40kg, as well as system power needs.

Ground to air

Ground to air

So far, all this talk of electrolyte and cell design has skirted around a simple and very interesting fact. The eVTOL manufacturers, be it Archer, Beta, Lilium and Joby in the US, or EHang in China, are all making use of existing cells. True, there are confirmations that the battery packs are being assembled in-house. The need for rapid testing cycles, higher power demands, housing that fits the aerodynamic design all mean it’s a necessity that cells be custom assembled into the packs.

Archer’s Midnight uses E-One Moli Energy Company’s Molicel P42A cylindrical lithium-ion, known for high-discharge capacity. And Joby’s S4 uses 811 NMC cathode, graphite anode, widely used by Tesla.

Given what ORNL says about the vast differences between the needs of cells in air as compared to ground, why are OEMs invariably using the standard cells found in commercially available EVs? To commercialize quickly, OEMs don’t want to take risks on ‘straight out of the lab’ cells, preferring those tried and tested in mass production. Novel cells pose a double risk, on the one hand that the eVTOLs will fail unexpectedly after commercialization, on the other that manufacturing will have to be halted and recalls issued.

Right now, OEMs are rushing to certify and commercialise, with investors ploughing huge sums into companies yet to turn a profit. This first crop promises to be functional, albeit with limited range. Without cells specifically designed for air travel, the cost of this relative predictability will be inefficiency, as components designed to push a vehicle along the ground struggle with their new function.

“The eVTOL program presents a unique opportunity for creating a brand-new type of battery with very different requirements and capabilities than what we have seen before,” says Belharouk. “It must be designed for the specific application. So, in manufacturing, we cannot design them as ground-EV batteries.”

All this is going to have wider implications for the EV sector, potentially pushing new chemistries like the air-battery and solid state, potentially making higher-power available to the ground-EV as well. Eventually, someone is going to be designing and assembling these cells. CATL have signalled early interest and have already formed a partnership with eVTOL start-up Autoflight. OEMs are pushing ahead, and for the moment they are not ready to act on the advice of national research institutions like ORNL. For the immediate future, the aim is just to get a product that is functional, safe and compliant with regulations. However, as soon as that race is run, another one begins; to develop and deploy specialised cells, tailor-made for the skies.

Joby Aviation S4

With its outer casing made from layers of lightweight carbon fibre, propulsion comes from six electric motors, two on the V-tail, four on the wings. It’s a tiltrotor, meaning the propellors swivel 90 degrees after take-off to fly like an ordinary plane with a 39ft wingspan. It weighs in at under 2000kg and has a maximum payload of 453kg.

For redundancy and safety each propeller has power from two separate motors, each of which is connected to the four on-board batteries. If an inverter or battery fails, the propellor continues to function. Toyota has invested $400 million into Joby, as well as providing talent directly. Currently a production-prototype, there is speculation that they will source cells for full scale production from the TBMNC $2.5bn plant, currently under construction.

With vertically integrated manufacturing, Joby assembles its battery packs from NMC cathode, graphite anode cells in-house. This allows for faster testing and development, although the 811 is known to be a little more thermally unstable and in need of more cooling. Joby has attracted Tesla’s big hitter engineer John Wagner as Powertrain Lead, they aim to start parts production and commercialization in early 2025.

Overair Butterfly

Considered a 2nd wave OEM, Overair bills the Butterfly as a sustainable, quiet, rideshare. It boasts being one of the most city-friendly eVTOLs at 55db and built with a view towards scaling up to larger aircraft. It can take a payload of 4 passengers, pilot and luggage, with airport transfers and ambulance service in mind.

The 6m wide propellors are larger than most eVTOLs. It adjusts Optimum Speed Tilt Rotor (OSTR) for RPM and Individual Blade Control (IBC) for angle, all in the name of efficiency gains and a smooth flight. Korean Hanwha Systems and Hanwha Aerospace invested $115 million and are co-developing the battery packs. Further details are sparse, but John Criezis, Head of Mobility, has mentioned that the Butterfly runs on conventional cells available at scale.

With a range of 100 miles and a 200mph top speed, it is also designed to withstand inclement weather, heat and higher altitudes. Toray Composite Materials America supplies the T1100 carbon fiber and 3960 epoxy prepreg which make up the airframe and rotor blades.