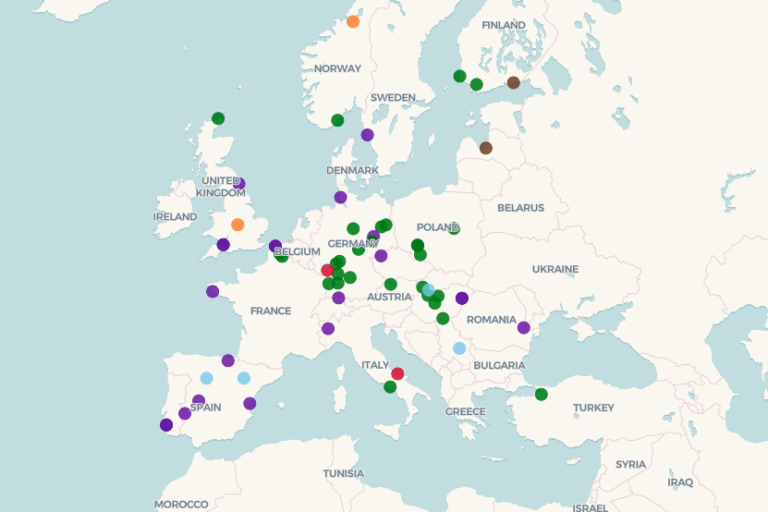

Europe’s battery supply chain has reached several development milestones as manufacturing facilities transition from construction to operation and new projects secure investment approvals across the continent.

The Gigafactory Envision AESC in Douai, France, has begun commercial operations, moving beyond construction to active battery cell production. The facility represents a significant step toward domestic European battery manufacturing capacity for EVs.

China Aviation Lithium Battery Group made a final investment decision on June 7, 2025, for its planned gigafactory in Sines, Portugal, with construction scheduled to begin this year. In the UK, the Agratas Gigafactory entered the construction phase with steelwork commencing in May 2025, adding to Europe’s expanding battery production pipeline.

The battery supply chain development extends beyond manufacturing to include raw material extraction and recycling projects. Altilium Recycling’s facility in Plymouth, UK, has progressed from permitting to active construction as the company develops battery material recovery capabilities.

Spain’s Aguablanca Mine project moved from permitting to construction after securing necessary permits in May 2025 to restart mining operations. The facility will supply raw materials for battery production. In Sweden, the Nunasvaara South Graphite Mine cleared final regulatory approvals and plans to begin construction in the third quarter of 2025, providing materials for battery anode production.

France’s EMILI lithium project advanced from a memorandum of understanding to the permitting stage, with public inquiries initiated in February 2025. The Sibanye-Stillwater precursor refinery project in France also entered permitting stages as part of efforts to establish local battery component supply chains.

“The speed at which Europe’s battery supply chain is developing is truly remarkable,” said Ben Nelmes, CEO of New AutoMotive. “From new gigafactories coming online to critical mining and recycling projects breaking ground, we are seeing the tangible results of concerted effort and smart policy. This isn’t just about building batteries; it’s about securing Europe’s industrial future, creating green jobs, and accelerating our transition away from fossil fuels.”

The project developments span the battery production value chain from material extraction through manufacturing and recycling. The progress reflects policy support including the European Union’s carbon dioxide standards for cars and vans, which have encouraged investment in EV infrastructure.

European battery supply chain development addresses strategic objectives including reduced dependence on imports, job creation in manufacturing sectors, and support for EV adoption across the continent. The combination of policy frameworks and private investment has accelerated project timelines from planning stages to active construction and operation phases across multiple countries and supply chain segments.